I reviewed new technologies in cosmetic ingredients at startup companies in this article in Cosmetics & Toiletries. Many startups use biotechnology to convert natural sugars and oils into value added ingredients. However, I conclude that big opportunities remain for innovation in this market. Contact me for more details.

Summary

Large global firms dominate the market for cosmetic ingredients. The largest of these offer ingredient portfolios with hundreds of chemicals for all ingredient functions in product formulations. However, today is perhaps the most active time in decades for small startup firms offering new chemistries for personal care. They are driven by strong market demand for natural (non-synthetic) and sustainable materials, as well as advances in green chemistry and fermentation technology. New substitutes are becoming available for many ingredients that were formerly derived from petroleum and other non-renewable resources. In this paper, we review the innovative ingredients created by startup firms and discuss new chemical trends in the personal care ingredients market.

Introduction

The personal and home care ingredients industry has existed for over a century. The first ingredient suppliers were established as companies more than 150 years ago. Many of these first generation firms still operate in one form or another. The secret to their survival is continuous innovation by developing new ingredient chemistries in response to changing market needs and safety regulations.

The largest ingredient suppliers have extensive product portfolios with many chemicals that have been used in applications for decades. This limits innovation for two reasons. First, often a new product launch will not be impactful enough to move the needle, i.e. generate meaningful new sales relative to overall portfolio sales. With a low payoff compared to other business strategies, the motivation to invest in innovation is reduced.

Second, innovation is risky. It requires investing capital in projects that may not give a return for years and sometimes fail to launch at all. Long term, disruptive innovation has a high project failure rate because the technology is new and market demand is uncertain. Many innovative products must be launched to find a few that are big hits with substantial market impact. For these reasons, established firms often have not invested in high risk innovation projects. Much lower risk is carried by investments in incremental improvements over existing products in a firm’s ingredient portfolio.

New product chemistry and functionality have generally been the realm of startup firms. These have often been started by academic researchers. If they have a good pitch, startup companies can gain investment and management support from venture capital firms and from established corporations in the industry, which often operate their own venture capital arms. In some cases, startup companies have been acquired by established firms, who see value in bringing the startup’s technology, patent portfolio, and management team in house.

A barrier to innovation in the personal and home care industry is the global regulatory environment. Learning from experience and based on consumer opinion, regulators worldwide have set strict rules on how new chemicals can be sold that are intended for application on human surfaces such as skin and hair, as well as for other uses. Clinical safety testing is required for all applications and geographies, which is often costly. However, the regulations have also created opportunity for designing chemistries that do not adversely interact with the body, such as peptides and oligomers. As polymers according to the OECD definition, these are mostly exempt from European REACH regulations, the most stringent regulatory framework for new chemicals. Another opportunity is in developing new ways of synthesizing existing chemicals, for example by using the principles of green chemistry (1). The environmental impact of those existing chemicals can be reduced by employing new synthesis methods, provided that the new methods don’t introduce unwanted or hazardous byproducts.

In this paper I will survey the startup landscape in home and personal care ingredients. I will review the new technologies about to enter the marketplace and identify trends in new ingredient development.

Chemical processes for manufacturing home and personal care ingredients are not green

Traditionally, synthetic chemical processes used to manufacture ingredients for personal and home care fall into three categories (2). First, a common process is ethoxylation of fatty alcohols, which can be obtained by hydrogenation of fatty acids synthesized by saponification of fats and oils. Fatty alcohols may also be synthesized directly using the Ziegler process (3). The feedstock in this process is ethylene and other unsaturated alkanes, derived from fossil fuels such as coal or petroleum.

The second process is esterification of fatty acids with alcohols. This process yields common emollient oils such as isopropyl myristate and hexyl laurate. And third, etherification is used to dehydrate alcohols to form ethers. For example, etherification can be applied to form hydroxypropylcellulose and related materials by ether formation with the hydroxyl groups of the cellulose feedstock.

Other chemical processes are used widely as well. Many personal care polymers are polyacrylates and polyurethanes. Alkyl polyglycosides (APGs) are a growing category of mild surfactants formed by reacting glucose and other glycosides with fatty alcohols. Sorbitan esters and polyglycerol ethers are cosmetic ingredients made with the above-mentioned processes.

These chemical processes have contributed to the availability of a wide range of personal care products that meet the performance and sensory feel consumers want at a low product cost. However, they have several drawbacks that create opportunities for new product development. Most do not use green chemistry and hence rely on nonrenewable feedstocks, release waste chemicals to the environment, or generate hazardous byproducts, such as 1,4-dioxane, that become part of the product. In recent years, consumers have increasingly demanded greener and more sustainable products (4).

Chemical ingredient startups are focused on green and natural ingredients

The increasing demand for green and natural cosmetic products, coupled with the growing visibility of the UN Sustainable Development Goals (5), has motivated startup cosmetic ingredient companies to focus on sustainable products and technologies. There are many small firms that develop new, sustainable ingredient chemistry with applications in cosmetics and personal care. Several have ingredients in their development pipelines that are now entering the marketplace.

First, the legacy chemical ingredients are mostly based on petroleum chemistry. Such ingredients include the long-chain fatty acids and their derivatives described in the previous section. Technologies developed at startups uniformly use natural and renewable feedstocks – none use petroleum or natural gas. This demonstrates that investment in new fossil fuel-based chemistry is currently not seen as offering a good return for startup firms, even though petroleum is inexpensive and petroleum-based chemicals are of high purity.

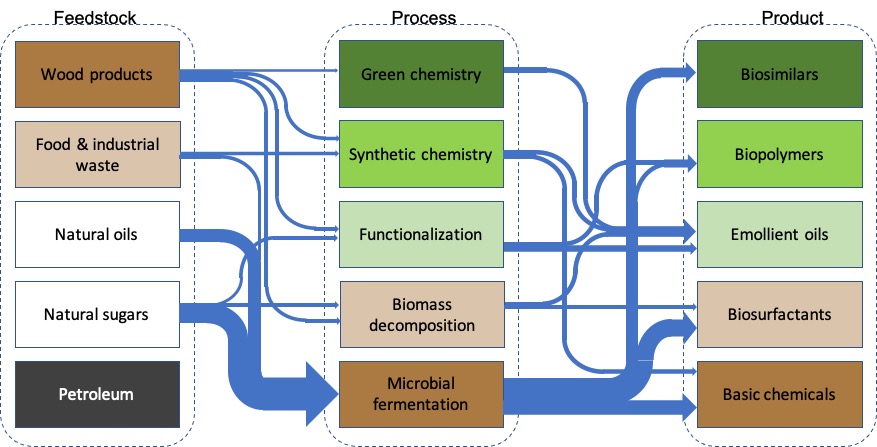

The innovative technologies at startup firms can broadly be distinguished by the feedstock used, which varies from natural plant-based sugars and oils, to food and industrial waste, and finally wood-based materials (Figure 1). These feedstocks are most often processed using microbial fermentation. Other processes used are decomposing and purifying biomass, either lignin from wood or the biomass of algae. Functionalization of natural polysaccharides is used to create functional biopolymers and emollients. Alteration of natural ingredients by chemical synthesis methods is also used.

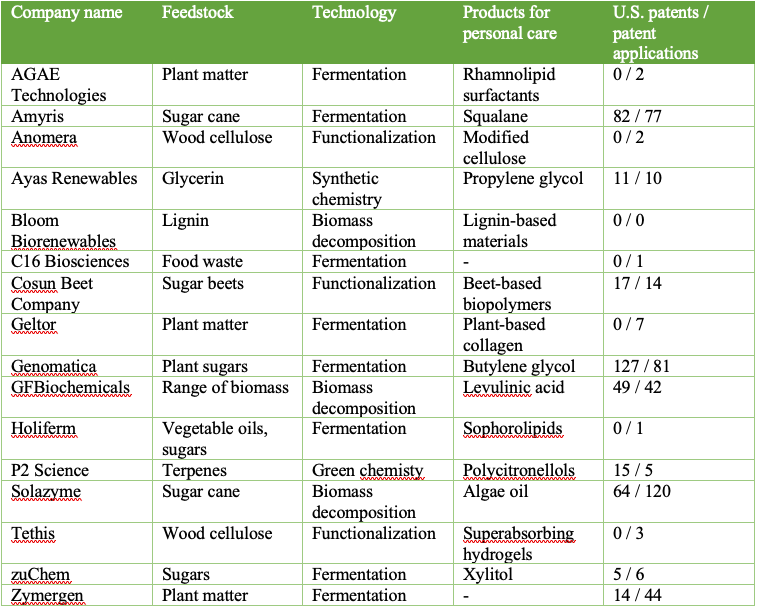

Building on technologies developed in the biofuels industry, some firms focus on making basic chemicals based on renewables (Table 1). Startup firm Ayas Renewables has developed a patented process to make renewable propylene glycolfrom glycerin, which is a waste stream arising from biodiesel production, thus making a basic chemical in a greener way. Genomatica, based in San Diego, uses biotechnology to make butylene glycol for personal care applications. It can make such bio-based products at substantially lower cost than with conventional manufacturing methods (6).

Biotechnology is the future for personal care ingredients

The products made by these firms are natural and renewable, but it is not clear if the production process is green. Fermentation is an exothermic process, but energy may need to be supplied to prepare the feedstock and agitate, cool, and/or aerate the reaction mixture (in case of aerobic fermentation). According to Genomatica, its fermentation process for production of butylene glycol has substantially lower emissions than the conventional process (7). Opportunities for innovation remain by lowering emissions further and making the process more green.

As illustrated in Figure 1, the dominant processing method startup firms use to make new personal care ingredients is fermentation. A wide range of ingredients can be made with this process, using renewable and natural feedstocks, which are generally plant-based sugars and oils. The ingredients produced contain fewer contaminants and byproducts than plant extracts (8).

Fermentation is an ancient process and not confined to startup firms. A number of global chemical makers has invested in fermentation plants and commercialized new personal care ingredients. A leader in this area is German firm Evonik, which has produced glycolipid biosurfactants, specifically sophorolipids, for home and personal care. Stepan has entered this field as well with its acquisition this year of NatSurfAct, a maker of rhamnolipid biosurfactants by fermentation of vegetable oil. BASF has been active since 2015 when it launched an algal betaine surfactant derived from microalgae oil in a collaboration with Solazyme. Finally, Inolex markets a cationic emulsifier produced by fermentation of plant materials.

A higher value added ingredient made by biotech methods is the plant-based collagen offered by Geltor. An advantage of production of bioactive ingredients by biotech methods is that they are stereospecific: for example, ceramides made in this way are similar to those in human skin, whereas those produced by synthetic chemistry are racemic mixtures and less suitable for skin applications (8).

Table 1. Startup firms in the personal care ingredient industry. The list is subject to change as many of the companies listed are patenting and commercializing new technologies.

Novel natural ingredients can be more sustainable

Sometimes new chemistry with sustainability benefits can be found in nature. Argan oil has been in high demand for cosmetic applications due to its antioxidant properties and beneficial impact on local communities cultivating the argan tree in Morocco. This high demand has led to challenges because of the increasing scarcity of the argan fruit, but its ecological benefits for the argan forest and socioeconomic benefits to local communities are not contested (9). Similar benefits are offered by illipe butter, which is made from the nuts of a tree grown in the rainforests of Borneo in a factory run by Forestwise. The harvest of this material and similar rainforest products benefits local communities by making the rainforest a source of income (10).

Other hitherto unused natural ingredients can substitute for synthetic chemicals in personal care products. Anomera is a Montreal-based company that makes carboxylated cellulose nanocrystals based on wood cellulose that can be applied as microbeads in cosmetics, substituting for plastic microbeads that are not biodegradable. Lignin is a wood product that can be converted into useful ingredients for personal care. This is the focus of several startups because lignin waste, obtained as a byproduct from paper production, is so abundant. However, lignin is a difficult molecule to break down into useful ingredients because it consists of crosslinked phenolic polymers. A firm that has been successful in converting lignin waste is Swiss firm Bloom Biorenewables, which uses a separation method to isolate the lignin fraction from the cellulose fraction in waste wood. The lignin can then be depolymerized to yield small aromatic molecules for fragrance applications. The cellulose part can be functionalized for application in cosmetic products. These processes avoid the traditional burning of the waste wood as fuel and therefore lead to much lower greenhouse gas emissions.

Tree sap is another forest product that can be collected and converted into useful materials. Connecticut-based P2 Science has commercialized cosmetic oils and waxes based on terpenes, which are obtained from the distillation of pine tree resin. A wide range of ingredients can be manufactured with this feedstock using green chemistry principles. These and similar ingredients are fully sustainable, a key property in the global cosmetics market.

Biosimilar ingredients can be more sustainable than natural ingredients

A risk to the conversion of the cosmetic ingredients marketplace to biobased materials is that the ecosystems growing the natural feedstocks can come under serious stress due to overexploitation. The large-scale production of palm oil in Southeast Asia has led to deforestation, loss of biodiversity, and poor labor conditions in the local population. With the Roundtable on Sustainable Palm Oil (RSPO), the cosmetics industry has created a mechanism to certify sustainable palm oil and make it attractive for cosmetics brands to use RSPO certified palm oil. This could be a model for other natural resources as well, since similar sustainability issues exist in coconut oil and other natural materials. However, even with the widely recognized RSPO certification, non-certified palm oil continues to find a market (11).

To stop further degradation of ecosystems that produce cosmetic ingredients, biosimilar materials can be produced by fermentation of waste streams such as food waste. New York firm C16 Biosciences has developed a process for producing oils that are almost indistinguishable from palm oils in their chemical and physical properties, but that are based on fermented food waste (12). This idea brings the natural ingredient movement almost full circle back to synthetic and nature-identical ingredients, but made using green chemistry and non-fossil fuel feedstocks. If this process can become cost competitive with natural palm oil, it may be possible to avert further environmental damage from harvesting natural oils and sugars. However, nature-identical materials may not meet the consumer demand for fully natural products.

Commercialization pathway for new ingredients and technologies

The range of new product technologies developed by startup companies in the personal care ingredient industry is very broad. However, relatively few new ingredients are applied in large scale applications. There are high barriers to broad market adoption of the new ingredients that need to be removed before they can be used widely.

Chief among these barriers is cost. The cost of biosurfactants such as rhamnolipids and sophorolipids that have been on the market for a few years can be a multiple of the price of established, commodity surfactants (13). Those prices have come down and the cost pressure may be less in other, less commoditized areas of the ingredient industry. Also, if the feedstock for new products is currently discarded as valueless waste, the product will be more competitive, in addition to the sustainability benefits (14). Examples of abundant waste streams are food waste, lignin, and agricultural waste such as orange peels.

Another major barrier is product performance. In many applications, petrochemical materials perform better than plant-based materials (15). Unless there is a clear benefit to using a new ingredient, it does not make business sense to substitute a high performance petrochemical ingredient with a newly developed version. The new ingredients needs to offer benefits that are visible to the consumer to outweigh its higher price and switching cost.

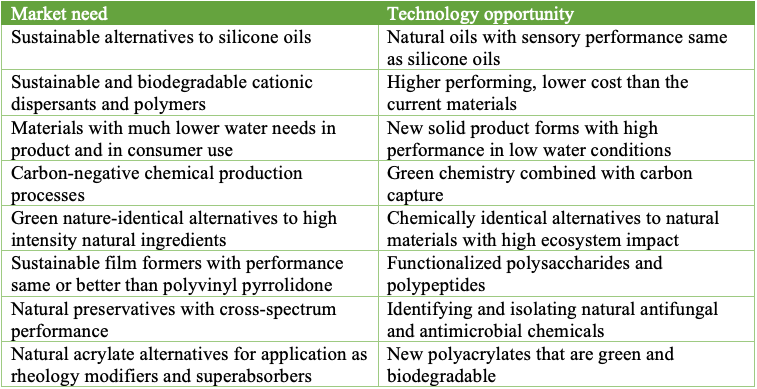

The new materials that are currently commercially available or close to commercialization are biosurfactants and natural oils and emollients. There is a receptive market for cosmetic oils and esters that have sustainability benefits. However, the market niche is still small, and their petrochemical equivalents still dominate the industry. In a prior article I outlined a few ingredients that are difficult to replace by sustainable materials, notably acrylate polymers and silicones (4). The technologies in development at emerging companies mostly do not address those markets, which leaves a big opportunity on the table (Table 2).

Table 2. Opportunities for new ingredient technologies in personal care

Conclusion

Many startup firms have introduced or are about to launch new chemical ingredients for personal care. They are driven by strong market for green materials, as well as advances in green chemistry and fermentation technology. However, big opportunities for new technology development remain in the personal care ingredients marketplace.

References

- P.T. Anastas, J.C. Warner, “Green Chemistry: Theory and Practice”, Oxford University Press (1998).

- Chemistry and Technology of the Cosmetics and Toiletries Industry, 2nd ed., edited by D.F. Williams and W.H. Schmitt, Chapman & Hall, London (1996).

- U.R. Kreutzer, “Manufacture of fatty alcohols based on natural fats and oils”, J. Am. Oil Chem. Soc. 61, 343–348 (1984).

- M.N.G. de Mul, “Second Nature: Sustainability as the Outgrowth of Naturals, A Commentary”, Cosmetics & Toiletries 2020, July 1 issue.

- “Transforming our world: the 2030 Agenda for Sustainable Development”, United Nations General Assembly resolution A/RES/70/1 (2015).

- S. Weiss, “Harnessing Biotechnology: A Practical Guide”, Chem. Eng. 2016, April issue, 38-43.

- E. Stuart, “Genomatica Announces Large-Scale Production of Brontide Butylene Glycol”, Cosm. Toiletries January 15, 2019.

- C. Agapakis, K. McDonnell, J. Kakoyiannis, “Moving Toward Microbes: Bio-engineering a New Cosmetic Reality”, Cosmet. Toiletries February 6, 2017.

- Z. Charrouf, D. Guillaume, “Sustainable Development in Northern Africa: The Argan Forest Case”, Sustainability 2009, 1, 1012-1022.

- M. Behrens, “Forestwise Sustainably Supplies Illipe Butter”, Cosmet. Toiletries May 5, 2020.

- V. Shah, “Companies worth trillions tell RSPO to improve standards”, Eco-Business June 9, 2015. https://www.eco-business.com/news/companies-worth-trillions-tell-rspo-to-improve-standards/

- A. Peters, “Bill Gates just invested in this company that grows palm oil in a lab—not the rain forest”, Fast Company, March 3, 2020.

- C.A. Bettenhausen, “Rhamnolipids on the rise”, Chem. Eng. News 2020, June 15 issue, 23-24.

- C.E. Drakontis, S. Amin, “Biosurfactants: Formulations, properties, and applications”, Current Opinion in Colloid & Interface Science 2020, 48:77–90.

- R. Guenard, “New developments in vegetable oil materials science”, INFORM magazine, October 2020.